India Ratings & Research (Ind-Ra) has upgraded SRS long-term issuer rating to 'BBB' from 'BBB-'. The outlook is positive. The agency maintains an 'tA-' rating on SRS's Rs 400 million term deposit.

Strong Financial Growth: SRS registered strong growth in revenue (up 19% yoy) and profit (up 31% yoy) in FY14, driven by the improved performance of its jewellery business. The jewellery business (over 90% revenue contribution in FY14) grew despite adverse regulatory changes during the year, indicating the company’s ability to withstand an adverse business environment. The profitability is likely to improve further driven by a higher focus on the retail jewellery business and the procurement of gold from Produits Artistiques Métaux Précieux (PAMP) as well as the availability of gold-on-loan schemes which might reduce the procurement and financing costs. In 1HFY15, SRS reported revenue of INR19.5bn (up 23% yoy) with EBITDA margin improving to 3.8% (1HFY14: 3.3%) and net profit to INR321m (up 99% yoy).

Strong Financial Growth: SRS registered strong growth in revenue (up 19% yoy) and profit (up 31% yoy) in FY14, driven by the improved performance of its jewellery business. The jewellery business (over 90% revenue contribution in FY14) grew despite adverse regulatory changes during the year, indicating the company’s ability to withstand an adverse business environment. The profitability is likely to improve further driven by a higher focus on the retail jewellery business and the procurement of gold from Produits Artistiques Métaux Précieux (PAMP) as well as the availability of gold-on-loan schemes which might reduce the procurement and financing costs. In 1HFY15, SRS reported revenue of INR19.5bn (up 23% yoy) with EBITDA margin improving to 3.8% (1HFY14: 3.3%) and net profit to INR321m (up 99% yoy).

The company's moderate credit profile is thus likely to improve. Interest coverage (operating EBITDAR/interest expense + rents) was 1.8x in FY14 (1.6x) while net financial leverage (net adjusted debt/EBITDAR) was 4.0x (6.2x).

The company's exports increased to Rs 3.92 billion in FY14 from Rs 2.2 billion in FY13. The rise in exports was partly a result of the government's restriction on the import of gold in India with the 80:20 scheme. This reflects the flexibility in the company's operations which resulted in a steady procurement of gold even in a constrained supply environment. In FY14, the company entered into a master franchise agreement for jewellery export. According to this agreement, SRS will export 1,200kg gold jewellery every year.

SRS is part of the larger SRS group and has access to group's resources. SRS itself has presence across several businesses such as multiplex, retail and jewellery. These diversified businesses help the company cross sell. The company enjoys a moderate brand recall among retail customers in North India and leverages the group’s strong brand awareness in the NCR-Faridabad region.

SRS has an established relationship with its customers in the wholesales gold jewellery business. This is reflected in the company’s ability to manage its debtors (the majority of which are unsecured) even in a volatile gold price environment. SRS has reported negligible bad debt in the past three years. However, the business (wholesale gold jewellery, 93% of jewellery business) faces high customer concentration with the top 10 customers accounting for 69% of sales in FY14.

The company has a sound track record of efficiently managing its inventory by replenishing the amount of gold sold on the same or the following day to limit inventory losses.

The company’s working capital cycle remained long at 73 days in FY14. With increasing contribution from the retail business in the jewellery segment the working capital cycle is likely to lengthen further. However, given the higher profitability of the retail jewellery business, the higher requirement is unlikely to impact the overall credit profile of the company. In addition, with a shift from wholesale jewellery business to retail, the debtor days are also likely to reduce.

The Indian jewellery industry continues to be highly fragmented and competitive, resulting in low profit margins. Although there has been a gradual shift in consumer preferences towards large organised players, this has been largely restricted to Tier 1 cities. Even these cities are witnessing higher competition within the organised segment. Regulatory restriction to dampen gold demand in India could negatively impact the domestic jewellery industry. In the past too, the government has increased custom duty rates on gold to contain current account deficit. The Reserve Bank of India’s restrictions on financing gold business impacted domestic gold volumes in FY14.

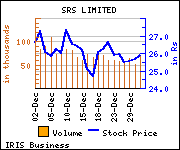

Shares of the company gained Rs 0.25, or 0.97%, to settle at Rs 25.90. The total volume of shares traded was 68,903 at the BSE (Wednesday).